Office Address

257 Old Churchmans Road, New Castle DE, USA - 19720

257 Old Churchmans Road, New Castle DE, USA - 19720

Since we all know the impact of income taxes on the businesses, the sleeping giant of payroll taxes often grabs company owner and employees by surprise.

We have brought to you an overview of what is the payroll tax, why they are important to be cared and how they affect your business. Hint — they’re kind of like the brick-stacking game where one mistake can send the whole thing toppling down.

"Payroll taxes are incredibly complex and leave zero room for error. We’ve seen numerous instances over the years of entrepreneurs facing extreme consequences because they failed to plan ahead and deal with their payroll taxes during the year. While procrastination can be tempting – you risk major issues unless you work with professionals to take this administrative burden off your plate and ensure it is handled correctly.”

— Brendon Pack, Senior VP, Sales 1-800Accountant

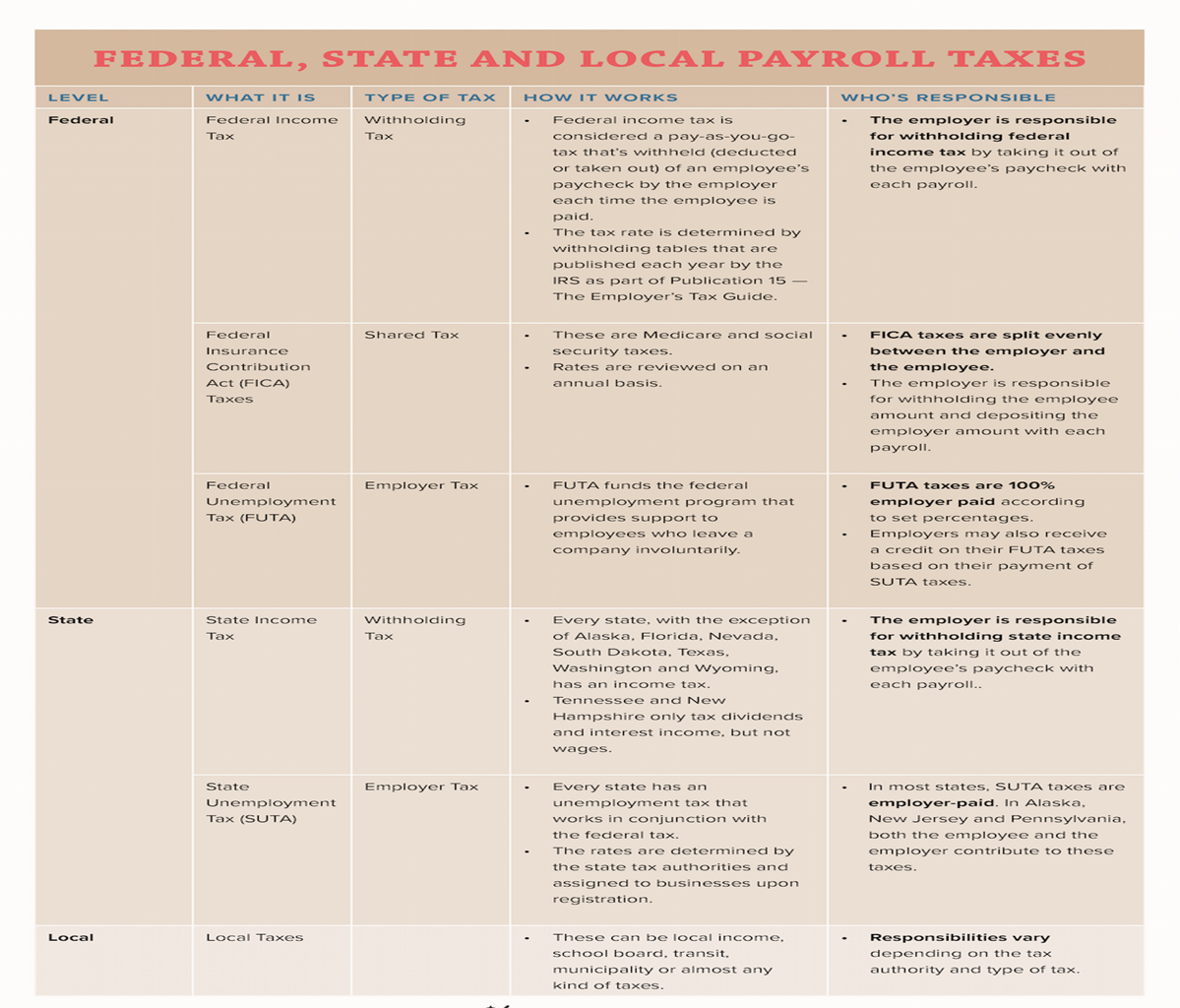

A payroll tax is a part of money taken out from an employee's paycheck by the employer and pays it to the government on the behalf of the employee. Payroll tax is based on wages, salaries bonuses etc. paid to employees. There are federal, state & sometimes local taxes. Payroll taxes are directly deducted from the employee's paycheck and paid to the Internal Revenue Service (IRS), State agency & the local tax body. Some taxes are employee tax, some are employer tax and some of the shared taxes (EE & ER).

The federal payroll tax funds to the technologies, Education, Development, Medicare, Medicaid and Social Security. This goes into the general fund of the U.S. Treasury.

Most of the States as well as few cities & county also impose income taxes on employee’s paycheck and to the employer as well and these amounts are paid directly to their coffers. Federal unemployment taxes (FUTA) for each of their employees is paid by the employer. This is the 6% of annual wage base limit of $7000/- (Maximum for each employee $420/-)

Unlike the U.S. income tax, which is a progressive tax, payroll taxes are levied only up to a certain yearly limit. Any income that exceeds the limit, set at $142,800 in 2021 ($137,700 was in 2020), is untaxed, making the U.S. payroll tax a regressive tax.

Payroll taxes in addition to income taxes are collected by federal authorities and some state authorities. Employees pay stubs contain the payroll tax deductions under the tax deductions. It shows value of withheld federal, state, and municipal income taxes as well as the amounts collected for Medicare and Social Security payments.

These collection of taxes is used by the government to fund the some of the specific programs such as Technologies, development, education, Social Security, healthcare, and workers' compensation. In some states/cities local governments collect a relatively small payroll tax (local tax) to maintain and improve local infrastructure and services, including first responders, road maintenance, and parks.

Employers are responsible for funding the unemployment insurance. If they terminate any employee, employee will be eligible to receive the unemployment benefits. The rate of unemployment insurance paid by the employer varies by industry, state, and federal fees. Employees are required to contribute to unemployment and disability insurance in some of the states.

Federal taxes include Social Security and Medicare contributions, which constitute the Federal Insurance Contributions Act (FICA) tax. An employee pays 7.65%. This rate is divided between a 6.2% deduction for Social Security on a maximum salary of $ 142,800/- in 2021 ($137,700 in 2020) and a 1.45% share for Medicare.

Employer is also liable to contribute the same percentage in FICA 7.65%

There is no wage base limit on Medicare contribution, but employee who earns more than $200,000—or $250,000 for married couples filing jointly—pays another 0.9% for Medicare.

The premise of Social Security and Medicare is that you pay into them during your working years in order to qualify to withdraw these funds after retiring or under certain medical circumstances.

Employees pay 6.2% into Social Security for the first $ 142,800/- earn in 2021, it gets updated every year, another 1.45% into Medicare, there is no wage base limit on Medicare, 0.9% will be an additional contribution once earning goes beyond the $200,000/- this additional contribution will only be contributed by EEs, so in this case EE total contribution will be 2.35%(1.45+0.9)

Individuals including contractors, freelance writers, Self-employed and small business owners are also liable to pay the payroll taxes. These are referred to as self-employment taxes.

People who are self-employed don't have employers to withhold the taxes and pay to the related agencies on their behalf unlike the salaried employees. They have to cover both the employer and employee’s tax on their own.

The self-employment tax rate is 15.3%. There are two parts to this rate, including a 12.4% contribution to Social Security (EE+ER), 2.9% payment to Medicare (EE+ER).0.9% additional Medicare applies to self-employment earnings that exceeds $200,000.

Social Security contribution funds to different trustees: the Old-Age and the Survivors Insurance Trust Fund (OASI), trustees use these funds to fulfill the retirement and survivor benefits, and the Disability Insurance. The Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, the Commissioner of Social Security, and two public trustees manage these trust funds.

As mentioned above, payroll taxes also go toward Medicare. These payroll deductions go to the two separate trust funds, The Hospital Insurance Trust Fund and the Supplementary Medical Insurance Trust Fund.

Individuals enrolled in Medicare pay a monthly income-based fee for basic Medicare coverage and are responsible for a portion of their medical costs.

There is a distinction between a payroll tax and an income tax, though both are deducted from paychecks. Payroll taxes are used to fund specific programs. However Income taxes go into the U.S. Treasury.

Everyone pays a flat payroll tax rate, up to a yearly cap, however Income Taxes are progressive, rates vary based on an individual's earnings. State Income tax goes into the state's treasury.

Collecting and Reporting Payroll Taxes

Payroll tax should be paid to the appropriate tax authorities by the employer for both the employer and the employee’s tax parts.

Your payments to tax authorities should be scheduled according to the size of your company and the amount of tax you pay. You will be given your payment schedule, when you register your business with the IRS and any other authorities.

Employers responsible for filing regular reports-

Payroll tax amounts collected from payroll and paid to the IRS, state and local tax authorities.

At the end of the year employers must provide W-2s to their employees and the relevant tax agencies by January 31.